China wants a friend, Clean energy deals, and Crypto cools off.

🗓 Morning! And happy Monday.

Global markets remain choppy, but a new leader has emerged in the stock races — Europe.

After mostly being out of fashion for a decade, European stocks (Germany, France, Sweden, etc.) are ripping as the region announces BIG BALLS spending plans to catalyze infrastructure and defense.

Back home in India, the bottom may be in. The Nifty added nearly 2% last week—as some early investors bet that the sell-off may be mostly done.

What’s your call?

Otherwise, a short news day. Let’s hit it.

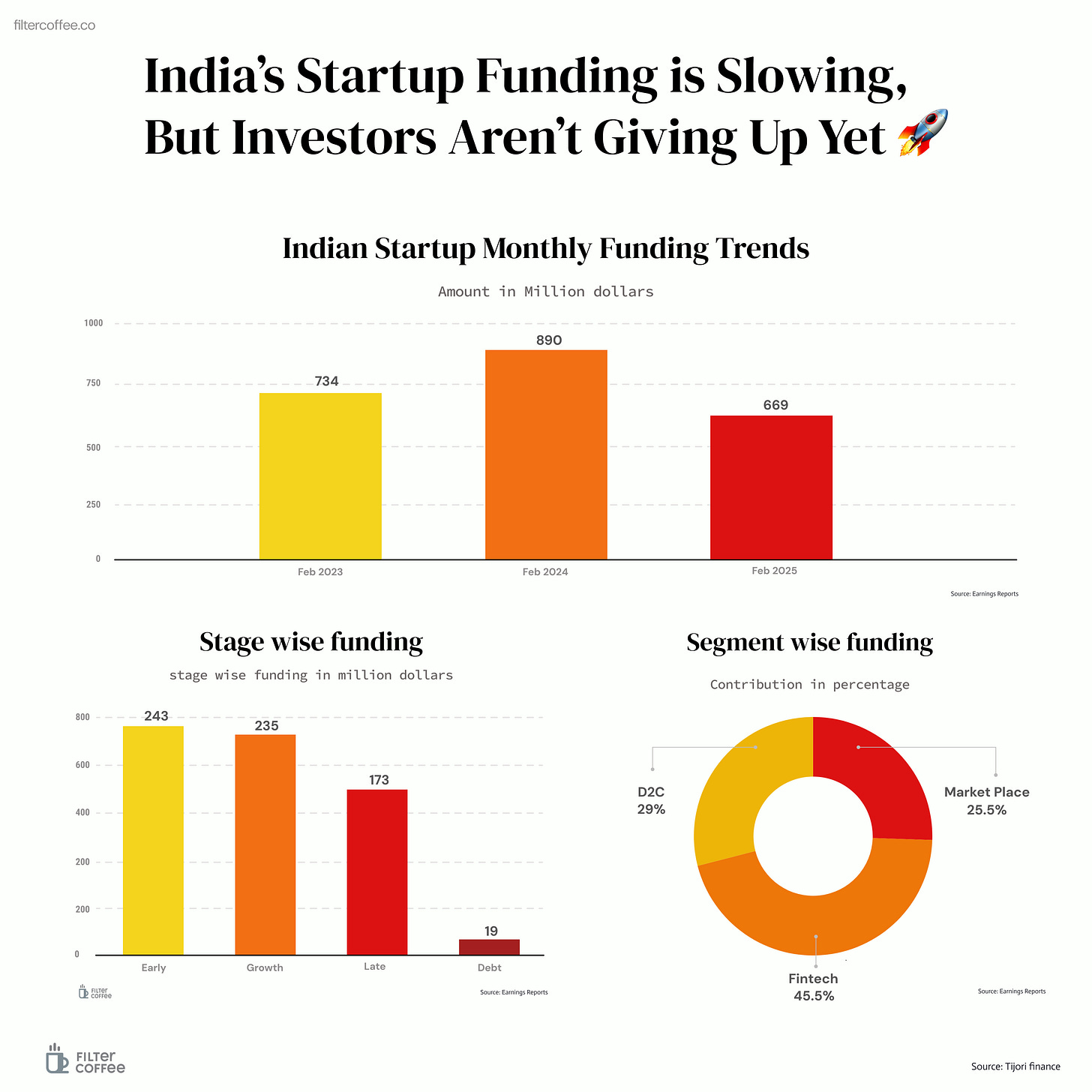

1 Big Thing: Venture funding slowed in Feb 2025 💸

The prolonged market winter weighed on India’s venture scene. For Feb, Indian startups raised $669 million across 100 deals, down 25% from last year and 6% lower than January’s $712 million.

What to consider: there were few big-ticket deals, with not a single startup pulling in a $100 million+ round. Six startups—Cashfree, Zeta, ToneTag, SpotDraft, Udaan, and Geniemode—managed to raise more than $50 million though, which is pretty impressive.

The one outlier was Zeta which hit unicorn status, now valued at $2 billion.

What’s ahead: Trump’s policy approach and the market volatility is making investors cautious. What sectors could suffer? How could the Indian consumer struggle? What new behaviors could emerge in a prolonged global weakness? Too many open ended questions.

Trend to watch: Fintech was the only sector to cross $100 million in funding, pulling in $143 million, while most others struggled to break into the eight-figure range.

Worth noting: IPO game has slowed significantly, with only five companies going public in January and four in February—way down from 16 listings in December 2024.

While we’re on raises ☝️

Swish, the company pioneering 10-minute food delivery, has raised $14 million in Series A funding from notable backers including Accel and Hara Global.

Launched less than a year ago, Swish relies on a network of cloud kitchens to power its rapid delivery system. The big question is whether this model can work.

What matters: Ten-minute delivery is comparable to what fast-food giants offer in the U.S. — noone expects a health-focused meal, but it fulfills a budget-friendly convenience need. The game is about optimizing backend operations down to the last detail, to power scale.

2. China shifts tone with India 🤝

A new, somewhat usual friendship may be brewing between India and China, something the market pundits haven’t fully priced in yet.

Most recently, China’s Foreign Minister Wang Yi called for greater collaboration, urging both nations to support rather than undercut each other.

This bromance, however, didn’t appear overnight. In October, Xi and PM Modi met on the sidelines of the BRICS summit.

Then at a G-20 summit, EAM Jaishankar met with the same Wang Yi, where Wang said the two countries should focus on big-picture cooperation, not just their differences. In his exact words “The Dragon and Elephant must dance together, not clash.”

Why now: Donald Trump’s theatrics has rattled global trade dynamics, prompting China to seek fresh economic allies.

While India’s ambition in Asia does clash with China’s, a closer India-China relationship could open doors for investments, tech transfers, and trade.

Notably, India still imports a substantial amount of goods from China, even as it attempts to reduce its reliance. Should the U.S. successfully detach its supply chains from China, maintaining access to India’s vast consumer market would become increasingly important for Beijing.

Bottomline: while interpreting what this means for the markets could be a long shot, collaboration between two of the largest economic power-houses is likely to be a no brainer net positive for business.

3. Biocon bags a new deal 🌍

Pharma giant Biocon is teaming up with a non-profit American Pharma company to make cheaper insulin in India, to help reduce cost of insulin in the U.S.

The deets: Insulin Aspart is a fast-acting insulin that helps diabetics control blood sugar levels. Biocon will supply the drug, while Civica will handle manufacturing and commercialization from its Virginia facility.

Biocon is already waiting for FDA approval for its own Insulin Aspart, but this deal helps it get a head start in the U.S. market.

Biocon stock is up 10% in the last five days.

4. Clean Energy continues to grab headlines 🔋

1. Wind power

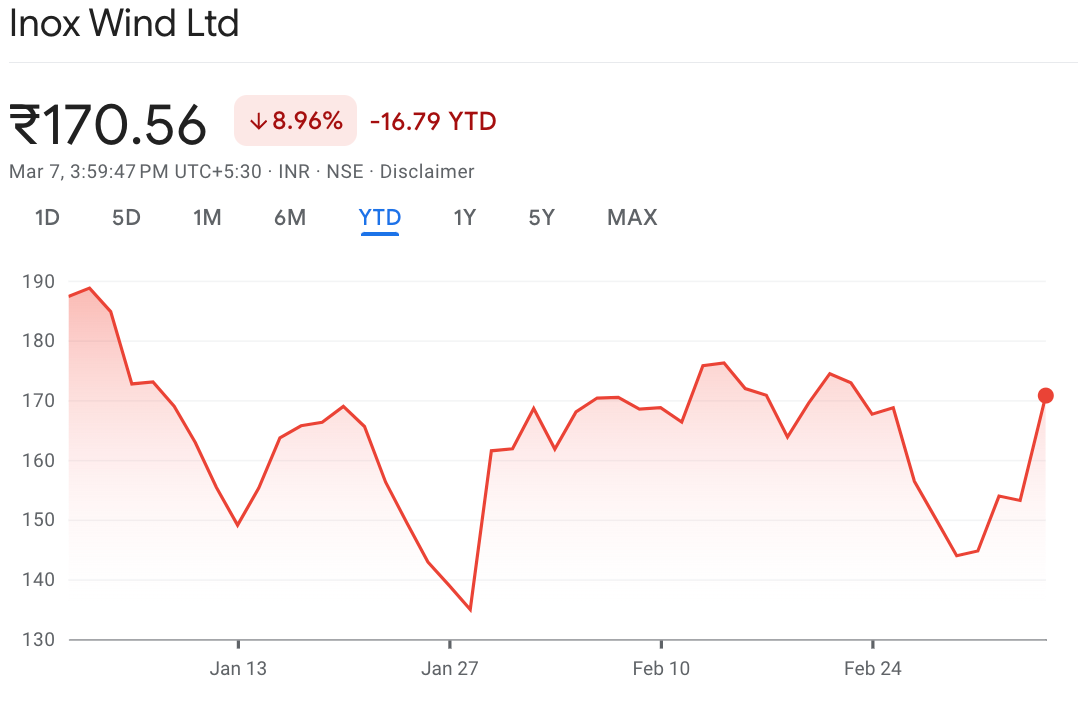

Inox Wind, supplier of wind power systems, surged 11% after securing a 153 MW order, its largest-ever, to build and maintain a wind farm in Tamil Nadu.

The deets: the project will be deploying Inox Wind’s advanced 3 MW class turbines.

India’s renewable energy capacity currently stands at 203.18 GW, accounting for 46.3% of the total energy mix.

The goal is to hit 500 GW of non-fossil fuel electricity capacity by 2030, which means doubling annual solar and wind additions over the next five years.

2. Tata Power flips the green switch in AP ⚡

Tata Power Renewable Energy is making a massive ₹49,000 crore deal to develop 7 GW of solar, wind, and hybrid projects in Andra Pradesh.

This is one of AP’s biggest renewable energy deals yet. Andhra Pradesh has a ₹10 lakh crore clean energy investment target and wants to generate 160 GW of renewable power, creating 7.5 lakh jobs in the process.

TPREL will lead feasibility studies and scout locations, while Andhra Pradesh’s Renewable Energy Corporation will provide land and infrastructure support to fast-track execution.

5. Foxconn to spend ₹20,000 crores in BLR 💰

Foxconn, a key Apple supplier and global electronics manufacturers, is making a ₹21,911 crore bet on Bengaluru, setting up a mobile phone manufacturing plant in the Devanahalli Industrial Area.

The facility will assemble 20 million smartphones annually on a 300-acre plot, with production expected to start soon.

Karnataka is rolling out ₹6,970 crore in incentives under its Electronics System Design and Manufacturing (ESDM) policy for the company. This would make Foxconn the first electronics giant to receive such a large package in the state.

The move also solidifies Bengaluru’s position as a rising hub for high-end electronics manufacturing, which due to rising costs, poor infrastructure, and other structural issues, was lately being questioned.

What else are we snackin’ 🍿

🇺🇸 Timeout: Trump delayed 25% tariffs on Canada & Mexico until April 2. He called it a short pause before the “big one” hit.

📉 Crypto cool-off: Bitcoin dipped below $90K after Trump’s U.S. Bitcoin Reserve plan didn’t quite live up to the hype.

💰 Chasing profits: quick Commerce platforms Blinkit & Zepto are tweaking commission structures to boost revenue & push profitability as competition heats up.

🚗 Tough ride: Tesla just logged its longest losing streak ever, with shares down for seven straight weeks since Musk joined the Trump administration.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.