Underwater drones, Ice cream brand bags funding, and Blue Dart hikes prices.

🗓 Morning, folks!

Markets slipped again on Tuesday, with Sensex and Nifty logging their 8th straight loss. The drag came from IT and auto names, while investors chose to sit tight ahead of the RBI policy.

Banks, though, played saviour. PNB and Canara Bank jumped close to 3% each, making PSU banks the rare bright spot in an otherwise dull session.

Now, the spotlight shifts to the RBI commentary. A rate cut is off the table, but traders are keen for any hint on where interest rates might be headed next.

💡 Spotlight: Amazon, Flipkart spark festive boom

India’s festive season has burst into action, with Amazon and Flipkart clocking record traffic and booming demand during their blockbuster sales, Big Billion Days and the Great Indian Festival.

What’s fuelling it? GST cuts and Gen Z shoppers are making this the biggest festive season yet. Online sales hit ₹60,700 crore in week one, up 29% YoY.

Mobiles dominated at 42% of gross merchandise value, while appliances and grocery stole the spotlight, growing 41% and 44% YoY.

Flipkart drew 606 million visits in 48 hours, with Gen Z making up a third of traffic, nearly double their usual share. Amazon saw a record 38 crore visits in 48 hours, with over 70% from beyond the top nine metros.

Let’s hit it!

1. Navy signs ₹47 cr deal with Kochi’s EyeROV for underwater drones 🌊

The Indian Navy has inked a ₹47 crore contract with Kochi-based startup EyeROV to supply advanced underwater drones.

EyeROV makes underwater robots (drones) used for defence, research, and industrial inspections. Customers include DRDO, Indian Coast Guard, CSIR, and NCPOR.

The deets: EyeROV will deliver its Underwater Remotely Operated Vehicles (UWROVs) - TROUT, tested in extreme missions including 400+ metres deep and even the Antarctic Sea.

Its TROUT model can dive 300 metres underwater and carry cameras or sensors to watch, scan, and gather data.

It’s basically a remotely operated mini-submarine designed for defence and commercial use.

Why it matters: for the Navy, it means access to reliable, deep-sea drones built for extreme conditions. For EyeROV, it’s a breakthrough contract that validates eight years of R&D and gives it credibility for global defence exports.

Zoom out: India’s underwater drone market was valued at about $109 million in 2024 and is expected to more than triple to $310 million by 2032, growing at a fast clip of over 18% annually.

2. Tata Steel joins Dutch govt to lower carbon emissions 🌍

Tata Steel has signed an agreement with the Government of Netherlands to start making steel at its IJmuiden plant with much lower carbon emissions.

What’s brewing: Tata Steel’s IJmuiden plant, one of the biggest polluters in the Netherlands, is taking its first step towards cleaner steel production.

A new Letter of Intent sets out the shared goals of Tata and the Dutch government for the initial phase of moving to low-carbon steel, while also improving the living environment around the site.

FYI: for years, the IJmuiden plant has faced criticism from local communities over pollution and health concerns.

Why it matters: the IJmuiden site is a cornerstone of Tata Steel’s European operations, making this agreement a key milestone in the company’s global decarbonisation strategy. It also fits into the Netherlands’ broader climate goals, which target sharp reductions in industrial emissions by 2030.

Big theme: steelmaking accounts for roughly 7-8% of worldwide carbon emissions, making it one of the hardest-to-abate sectors. Tata joins a growing list of global steelmakers exploring hydrogen-based production and other green technologies to cut emissions.

3. FIFA maker EA sold in record $55B private deal 🎮

Gaming giant Electronic Arts (EA) will be taken private in a $55 billion all-cash deal led by Saudi PIF, Silver Lake, and Affinity Partners.

What’s happening: the consortium will buy 100% of EA shares, with PIF rolling over its 9.9% stake. Shareholders get $210/share in cash, a 25% premium to its last close and above EA’s all-time high.

Note: this is the largest sponsor take-private ever, topping the $32B TXU buyout in 2007.

After effect: EA’s stock jumped 15% on Friday after the announcement, as investors cheered the premium. Analysts said the buyout will give EA more freedom to operate outside public market pressure.

Consequence: with hits like FIFA, Madden, Battlefield, and The Sims, EA could double down on content and distribution.

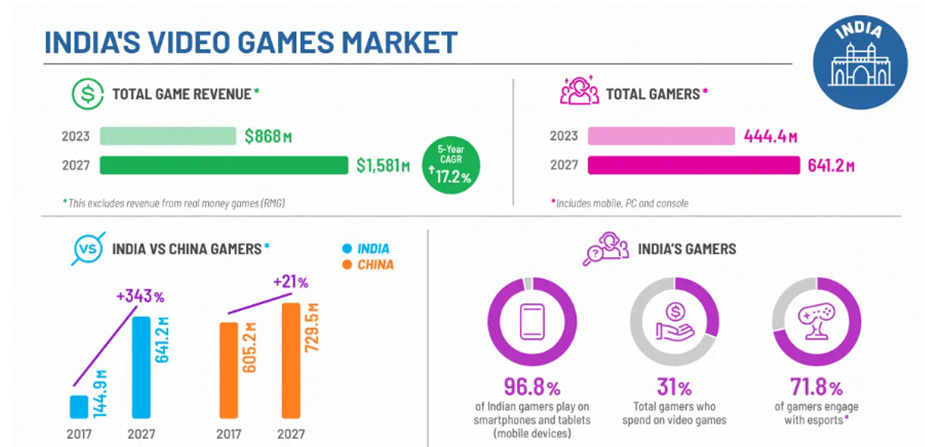

Big theme: the $180B+ global gaming market is a hotbed for mega deals as companies race to lock in content and audiences.

Microsoft scooped Activision for $69B, Sony has been snapping up studios to bulk up its PlayStation lineup, and Tencent is quietly buying stakes worldwide.

Now, with PIF leading a record $55B buyout of EA, it’s clear even sovereign funds see gaming as the next big growth frontier.

4. Hocco raises ₹115 crore in fresh funding to fuel expansion🍦

Ice cream brand Hocco just raised ₹115 crore in fresh funding now valuing the company at ₹2,000 crore.

Hocco is a food company started by former Havmor owners, the Chona family. They established the brand to cater to new-age customers with innovative recipes.

The deets: fresh proceeds will be used to expand capacity, bolster logistics, widen market presence and develop new products.

Why this matters: in a market largely dominated by legacy players like Vadilal and Amul, this fundraise signals consumer trust in innovative products and strong demand for premium offerings.

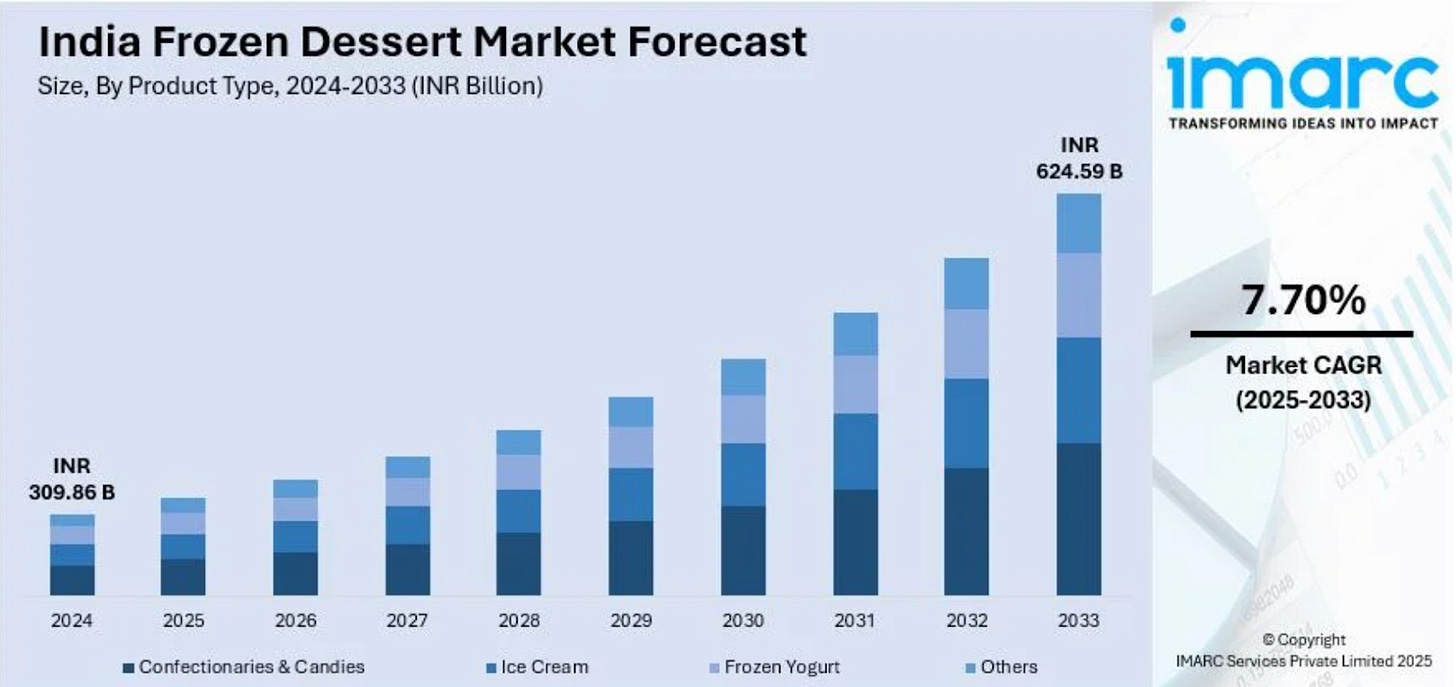

With Chona family’s expertise in the domain, the company can scale and gain a massive share in the rapidly rising frozen desserts market. The market is poised to grow at a rate of 7.7% and reach a valuation of ₹624.5 billion.

5. Stocks that kept us interested 🚀

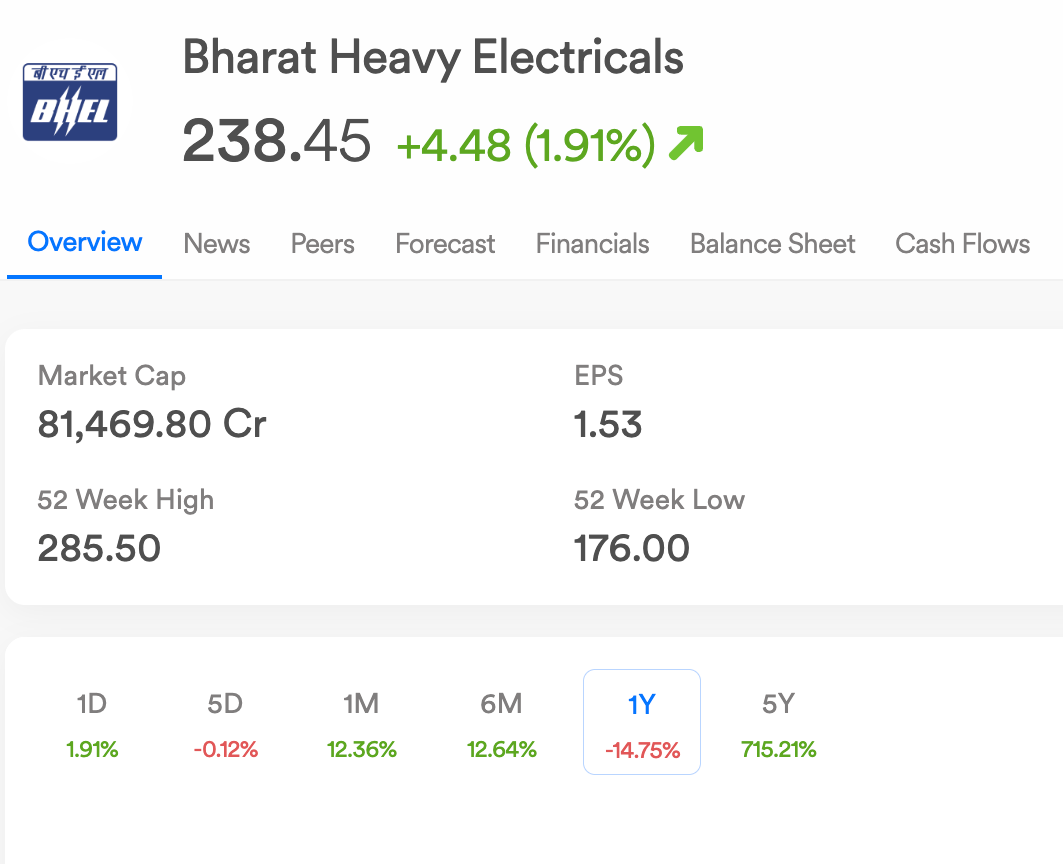

1. BHEL bags ₹15,000 cr Madhya Pradesh power order ⚡

Bharat Heavy Electricals (BHEL) landed a ₹13,000-15,000 crore order from MPPGCL to build two supercritical thermal power plants in Madhya Pradesh. The stock gained 2% following the update.

The deets: the packages cover 1x660 MW Amarkantak Unit 6 and 1x660 MW Satpura Unit 12, with EPC scope including equipment supply, civil works, erection, and commissioning.

Together, the Amarkantak Unit 6 and Satpura Unit 12 can generate 1,320 MW of coal-based power, enough to light up millions of homes in the state.

Why it matters: MP has been ramping up thermal capacity in recent years with projects like Adani’s 800 MW Anuppur plant and Torrent’s 1,600 MW project.

Adding another 1,320 MW through BHEL is critical as renewables expand but remain weather-dependent. The new plants will plug into MP’s expanding inter-state transmission network, allowing surplus power to flow to high-demand states like Maharashtra, Gujarat, and Uttar Pradesh.

Today, India has over 100,000 MW of supercritical capacity, and nearly every fresh coal project is based on it. Think of them as a bridge technology, not as clean as solar or wind, but far better than the old subcritical plants, ensuring reliable baseload power while renewables scale up.

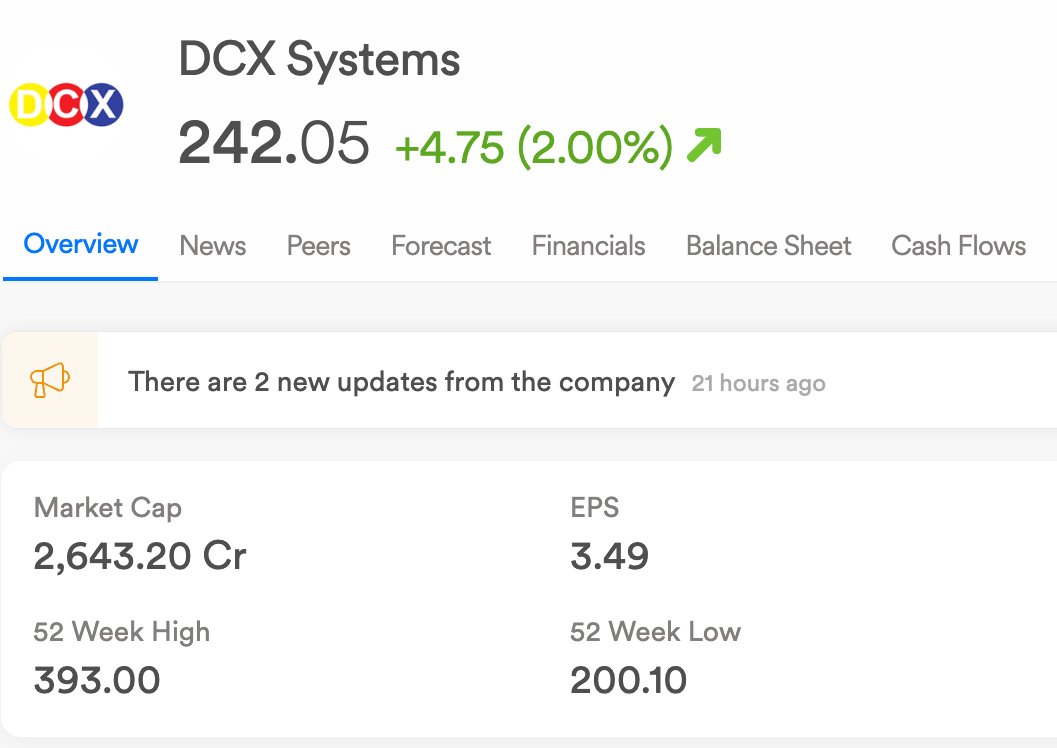

2. Israel-based defence tech taps DCX Systems for fresh orders 🇮🇱

Shares of DCX Systems was up 2% after receiving multiple orders worth ₹50 crore from Israeli-based defence tech ELTA Systems.

DCX Systems is an Indian defense manufacturing player for the manufacturing and supply of electronic systems, cable & wire harness assemblies, and printed circuit board assemblies. ELTA Systems, under Israel Aerospace Industries, makes radars, sensors, and electronic warfare solutions for defence.

What’s happening: the order book includes a ₹30.3 crore contract from ELTA Systems for the manufacture and supply of Electronic Module Assemblies.

Big theme: the wins align with India’s ‘Make-in-India’ and ‘Atmanirbhar Bharat’ push in defence manufacturing, as the India works toward reducing imports and positioning itself as a global defence hub.

The global defence electronics market is set to grow steadily at about 6% a year, opening up more opportunities for companies like DCX. By working with big international players such as ELTA Systems, DCX is securing its position in the global defence supply chain.

What else are we snackin’ 🍿

⚡ EV boost: India to set up 72,300 public EV charging stations under the new PM E-DRIVE scheme with subsidies for government offices, highways, malls and transport hubs to speed up electric vehicle adoption.

🤖 AI windfall: OpenAI posted $4.3 billion in revenue in the first half of 2025, up 16% but also burned $2.5 billion in cash to keep up with soaring demand and heavy AI development costs.

📦 Price hike: Blue Dart Express to raise shipment rates by 9-12% from Jan 1, 2026 after its annual pricing review.

That’s a wrap! Don’t let the weekday blues get to you.

Markets are closed tomorrow for Mahatma Gandhi Jayanti/Dussehra so we’ll be back like clockwork on Friday. 🤙

Hit that 💚 if you liked this issue.