☀️ Morning,

📈 Probably one of the busiest year-end periods.

🤖 Broadcom is the new AI king. The company’s stock has gone vertical, thanks to its growing role helping Big Tech make their own custom AI chips.

📉 Markets in India are feeling the pressure. Sensex is bouncing around at the same levels since early October, as inflation and growth-slowdown hold investors back.

Let’s go!

1 Big Thing: ₹1,000 crore farm credit guarantee 💳

The consumer affairs and food ministry introduced a ₹1,000 crore worth credit-guarantee program for farmers, backed by electronic negotiable receipts.

Why care: the scheme is designed to encourage banks to loan cash to farmers who store their produce in warehouses registered by the government.

With easy credit, GOI expects to help ease cash-flow issues that farmers face post harvest.

Electronic Negotiable Receipts — what are they? These are digital documents that prove ownership of goods, similar to paper receipts, but they can be easily transferred or sold electronically in the commodities market.

In India, Electronic Negotiable Receipts (ENRs) are issued by licensed warehouses under the Warehousing Act of 2007.

Context: nationwide, there’s roughly around 5,500 registered warehouses under the Warehouse Development and Regulatory Authority, which issue ENRs for farmers to utilize.

The fresh credit guarantee scheme also encourages warehouse operators to consider building more warehouse facilities closer to markets where farming density is higher.

Zoom out: agriculture supports the livelihood of over 40% of India’s workforce, and forms 18% of India’s GDP, which is significantly higher than mature markets like the US (10% of workforce, 5% of GDP).

2. $100 billion AI factory 🤖

One thing Masa Son can’t be accused of is dreaming small.

Masa met Trump in Florida yesterday, and announced a $100 billion commitment to build AI factories in the U.S. over the next four years.

Why care: the $100 billion figure has been mentioned several times in the context of AI infrastructure—both Sam Altman and Satya Nadella have hinted at similar ambitions recently also.

But the scale of this commitment signals the growing urgency to expand AI infrastructure and its critical role in the computing race.

The details: SoftBank plans to deploy the investment before the end of Trump’s term, possibly through its Vision Fund or its stake in chipmaker Arm Holdings. New capital could be raised too.

Also, their relationship goes way back: in 2016, SoftBank pledged $50 billion to create 50,000 U.S. jobs.

Big Picture: as giants like Meta, Google, Microsoft, and Amazon are set to spend over $220 billion this year on capital expenditures, the race to scale AI infrastructure is heating up.

Zoom out: with AI infrastructure becoming closely tied to national security, when will other major nations take notice?

3. Stocks that kept us interested 🚀

Dixon Technologies jumped over 4% this week after the company announced a joint venture with Chinese mobile phone maker Vivo.

FYI, Dixon is what they call an electronics manufacturing services company, which manufactures products for large brands like Sony, LG, and the rest.

Context: in the new deal, Dixon will hold a 51% majority stake, while Vivo India will hold the rest. The facility will assemble a lot of Vivo's smartphones in India, alongside a few other key customers as well.

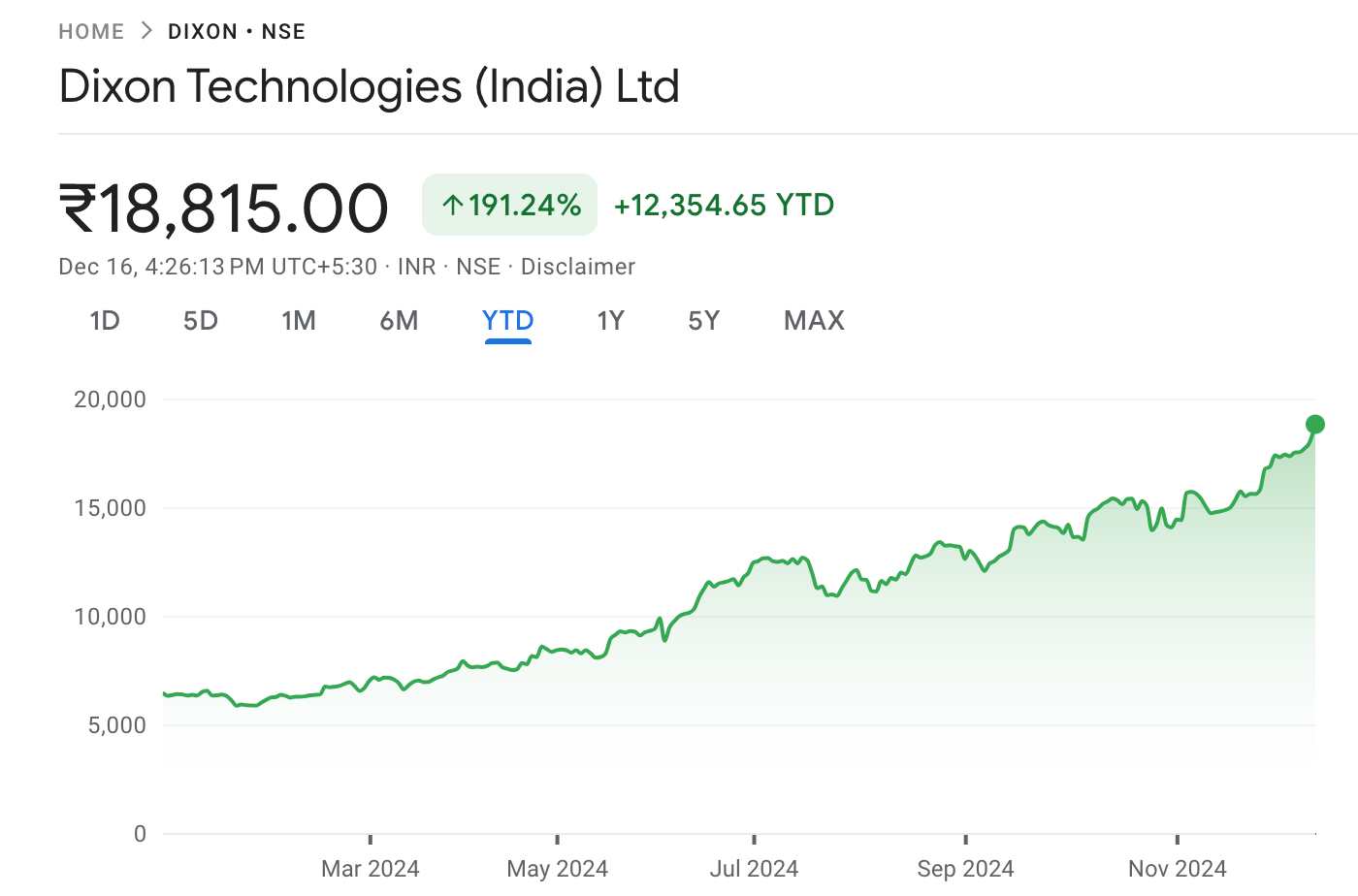

By the numbers: Dixon Technologies made bank in 2024, with the stock gaining over 190% this year. Sales grew 133% YoY for the most recent quarter. But, with a PE of over 200, valuations are starting to look a bit stretched.

HBL Power Systems’ stock moved up over 6% to an all-time high on Wednesday after winning a ₹1,522 crore order from Indian Railways.

HBL is a key supplier of power systems and components for railway’s KAVACH anti-collision system, which is one of the highest priority projects currently being pursued by the railways.

Context: Indian Railways is investing ₹2,700 crore to equip 10,000 locomotives with KAVACH, enhancing safety across its network.

Though the order will take 12 months to execute, the market is already factoring in the growth potential.

4. Acquisition spree continues 🧳

Blackberry sold its cybersecurity business, Cylance, to another cyber firm called Arctic Wolf for $160 million—a fraction of the $1.4 billion BlackBerry bought it for in 2018.

Why it matters: Blackberry, the device giant, was slowly making a transition into a cybersecurity software and hardware player, but that business has also mostly faced problems. Growth is elusive and stock just can’t catch a break.

The hype: as the global attack landscape continues to worsen, global cybersecurity market is projected to reach $345.4 billion by 2026, growing at nearly 10% annually.

While we are on acquisitions,

Wipro will acquire another small consulting firm called Applied Value Technologies (AVT) for $40 million in an all-cash deal.

AVT has a strong focus on cloud technologies. Wipro has been on an expansion strategy, filling gaps for the AI era. While back, they spent $5.8 million for a stake in SDVerse and the $66 million purchase of Aggne Global.

What else are we snackin’ 🍿

📉Billionaire shakeup: Ambani and Adani have both fallen out of Bloomberg's $100 billion club, as the Indian stock market continues to drag its feet relative to the S&P.

💉India’s Mpox push: Bavarian Nordic and India’s Serum Institute joined hands to produce Mpox vaccines for India.

👑 India's Google lead: Google appointed Preeti Lobana as head of its India business, filling a key role as it ramps up AI efforts in one of its most critical markets.

💰BTC goes up: Bitcoin advanced to $106,000 this week, following Trump’s comments suggesting a U.S. bitcoin strategic reserve similar to the oil reserve.

That’s a wrap! Don’t let the Weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.