HUL's stellar earnings, Drug win, and VinFast comes to India.

🗓 Morning, folks!

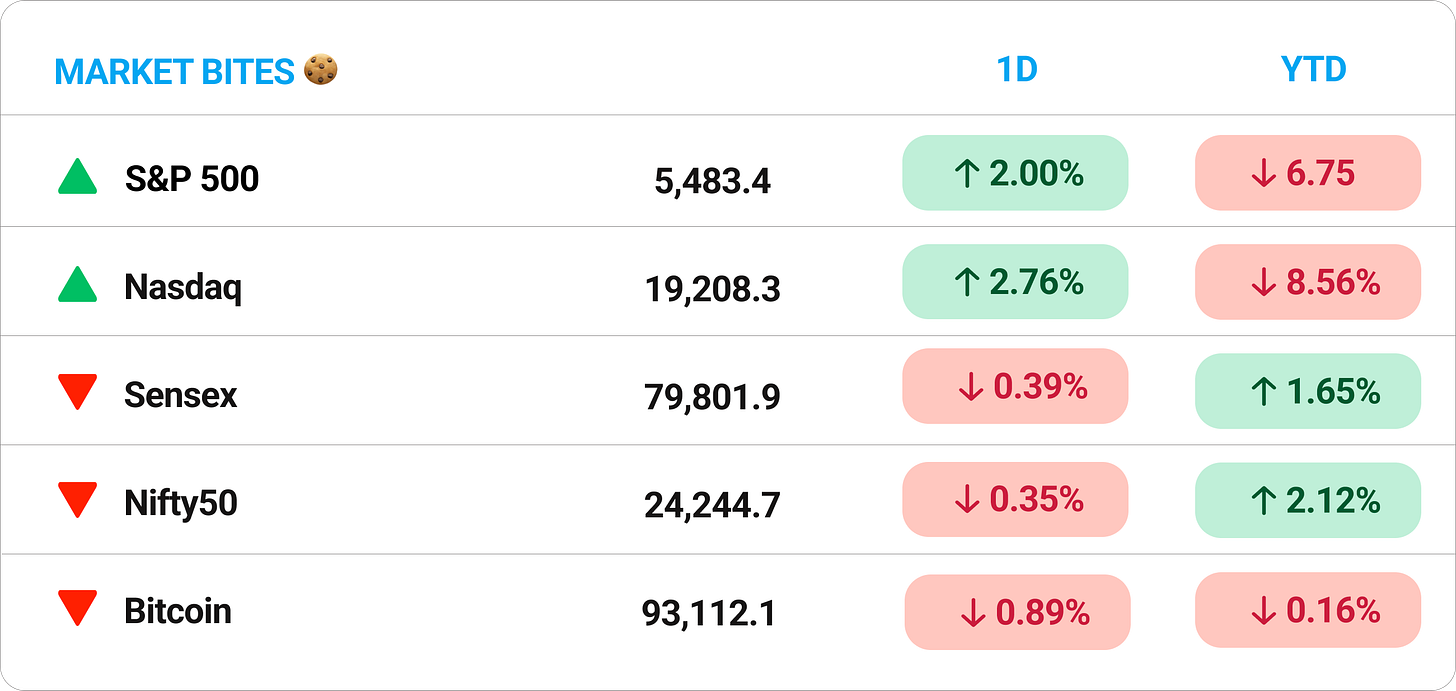

Markets hit pause on Wednesday, snapping a 7-day winning streak as investors locked in profits ahead of a busy earnings calendar.

Sensex and Nifty closed slightly lower, mirroring subdued global cues and cautious sentiment on the Street.

💡 Spotlight: the Nifty Auto index jumped earlier in the day after Trump hinted at softening the 25% auto import tariffs, but gains didn’t last as the index eventually closed in the red.

The US President said he may tweak the tariffs on imports from Mexico, Canada, and others, giving carmakers more time as current duties could hike car prices by thousands.

Let’s hit it!

1 Big Thing: HUL delivers a clean Q4 with cautious outlook 💰

FMCG giant Hindustan Unilever (HUL) posted a a decent Q4, with numbers that showed good growth, but failed to excite investors.

The numbers: Volumes rose 2% in the March quarter, ahead of expectations.

- Revenue: ₹15,213 crore, up 2.4% YoY

- Net profit: ₹2,493 crore, up 3.7% YoY—in line with estimates

Segment snapshot:

- 🧼 Home Care: ₹5,815 crore, up from ₹5,709 crore

- 💄 Beauty & Wellbeing: ₹3,265 crore vs ₹3,062 crore

- 🧴 Personal Care: ₹2,126 crore, flat from ₹2,063 crore

- 🍲 Foods: ₹3,896 crore vs ₹3,910 crore

Why care: markets generally look at large FMCG giants to understand what’s happening to the consumer. When growth is tepid, it may be signs that the consumer is starting to pull back a little.

But lately, these giants are themselves getting disrupted by new-age models, like quick commerce as well as modern brands which are favored by young consumers, which makes them a tough proxy for the broader economy.

Quick stat: Blinkit, Zepto, and Instamart now account for nearly one-sixth of HUL’s ecomm sales—especially in fast-moving categories like ice cream, noodles, and shampoo.

This urban shift towards 10-minute delivery is forcing even legacy brands to rethink access and agility.

The company also expects lower profits on each sale—now aiming for 22–23% margins instead of 23–24%. It blamed rising cost pressures and the need to stay affordable.

Post announcement, HUL’s stock, which was up as much as 2.5%, did a full U-turn and closed down over 4%.

While we are on earnings,

Nestlé also reported a soft Q4.

Profits dipped 5% YoY to ₹885 crore, while revenue rose 4.4% to ₹5,504 crore, led by steady demand across packaged foods, dairy, and beverages.

2. GIC acquires 31% of Samhi Hotels 🤝

GIC, Singapore’s sovereign wealth fund, is picking up a 35% stake in three hotel subsidiaries of Samhi Hotels for ₹752 crores.

The deets: Samhi Hotels is a hospitality company that owns and operates upscale and business hotels across major Indian cities. It partners with top global brands like Marriott, Hyatt, and IHG, focusing on high-demand urban locations.

This deal includes Courtyard & Fairfield by Marriott Bengaluru ORR, Hyatt Regency Pune, and Trinity Hotel in Whitefield, Bengaluru. The total enterprise value of these assets is ₹2,200 crore.

The structure is simple: GIC will co-own the properties, but Samhi will continue to run operations. The move is part of Samhi’s broader capital recycling strategy—raising funds through selective stake sales while retaining operational control.

The proceeds will help the company pare down debt and fund future expansion.

Big picture: this deal presents another piece of evidence of global money continuing to chase exposure to the Indian consumer.

Samhi’s stock jumped over 10% on the news.

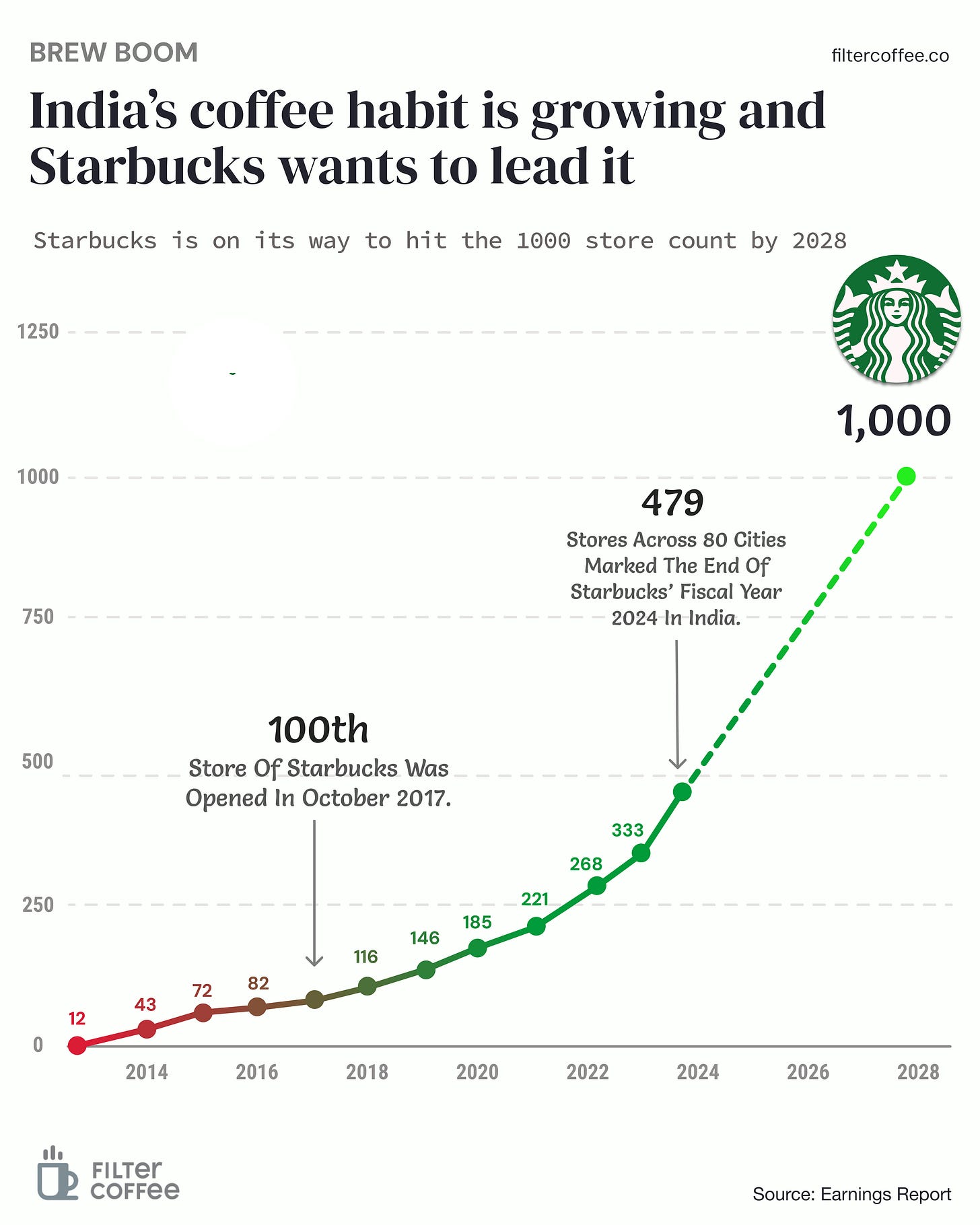

3. Starbucks makes a comeback in India ☕

After a brief period of slowdown and leadership changes at the global level, Starbucks is once again doubling down on an aggressive expansion in India.

Tata Consumer confirmed that the brand demand is recovering, and store expansion is back in motion.

India still drinks just 30 cups of coffee per person per year, compared to 200+ globally.

With urban incomes rising and café culture deepening, the runway is long—and Starbucks knows it.

4. Databricks’ big desi download 🧠

AI giant Databricks is investing $250 million in India over the next three years, doubling down on R&D and AI talent in Bengaluru.

The deets: the San Francisco-based data and AI powerhouse has opened a new R&D centre in Bengaluru, which is part of its elite global research network that includes San Francisco, Amsterdam, Berlin, and Seattle.

The company plans to grow its India workforce by 50%, aiming for 750 employees, including 200+ engineers at the new hub.

The why: Databricks builds tools that power the AI boom, from data engineering and analytics to machine learning.

The Bengaluru team will be critical in developing new products and infrastructure, with over 100 engineers hired this year alone.

5. Stock that kept us interested 🚀

1. Lupin’s drug win in the US

Lupin ended in the green after it launched Tolvaptan tablets in the US, a major step forward for its US generics portfolio.

The deets: Tolvaptan is used to treat autosomal dominant polycystic kidney disease (ADPKD), a chronic kidney condition where fluid-filled cysts grow in the kidneys, often leading to kidney failure.

In simple terms, the drug helps slow down the progression of kidney damage in patients with very few treatment options.

Why it matters: Lupin has bagged a 180-day head start to sell its generic version of Tolvaptan in the U.S. This means no other generic competitor can launch the same drug for the next six months.

The global chronic kidney disease (CKD) drugs market was valued at $14.5 billion in 2022 and is projected to reach $25 billion by 2030, growing at a rate of 7%+.

What else are we snackin’

🚗 VinFast zooms in: Vietnam’s EV giant VinFast, a global rival to Tesla, plans to open its ₹41,600 crore plant in Tamil Nadu by June.

✈️ Detour alert: Indian airlines reroute global flights as Pakistan shuts skies post J&K attack.

📶 Dues swap: Airtel signals interest in equity swap for spectrum dues, just weeks after Vi’s ₹36,950 crore deal.

💼 PF meets ATM: EPFO is working to launch a facility that will allow people to withdraw their provident fund savings via an ATM.

🍽️ Served hot: Devyani International is picking up over ~80% stake in SkyGate Hospitality for ~₹420 Cr.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.